Med info

Does Bupa Insurance Cover Vision Correction at Al Batal Specialized Complex?

We know that health insurance isn’t always easy to understand. In this blog from Al Batal Specialized Complex, we answer some common questions about how health insurance works and whether Bupa insurance covers vision correction procedures.

What Is Bupa Medical Insurance?

Bupa medical insurance is one of the leading health insurance options in Saudi Arabia. Bupa operates on the principle of helping people enjoy better health and maintain it throughout their lives, working every day to remain a global leader in healthcare.

Since the company was founded, its focus has always been—and will continue to be—helping people live longer, healthier, and happier lives. By recognizing that healthy people also need a healthy planet, Bupa aims to contribute to a better world. Its ambition is to become the most customer‑centric healthcare company in the world.

Main Features of Bupa Insurance at Al Batal Complex in Jeddah

Some of the key features of Bupa insurance at Al Batal Complex in Jeddah include:

[content to be filled according to clinic’s actual listed features]

What Does Bupa VIP Insurance Cover?

Bupa offers several different health insurance plans, and each plan provides a different level of benefits. You should consider your medical needs and choose the policy that offers the coverage that suits you best. Bupa VIP usually includes, among other things:

[content to be filled according to the specific VIP benefits]

Does Bupa Insurance Cover Vision Correction?

Bupa insurance generally does not cover refractive eye surgeries (such as LASIK and similar vision correction procedures) except in very rare, exceptional cases. In those cases, there must be clear medical evidence that surgical vision correction is the only possible option to treat the condition.

How Long Does It Take to Get Insurance Approval for a Procedure?

The insurance company is required to respond to a pre‑authorization request for treatment coverage within 60 minutes. Emergency cases are excluded from this requirement and do not need prior approval; however, the insurance company must be notified within 24 hours from the time the patient is admitted, as stipulated in Article (103) of the Implementing Regulations of the Cooperative Health Insurance Law.

Eye Procedures Covered by Bupa Insurance at Al Batal Specialized Complex in Jeddah

Whatever vision problems or eye conditions you may be experiencing, this sensitive medical specialty requires a thorough examination and an appropriate treatment plan by a skilled and experienced ophthalmologist, using effective medical tools that ensure positive outcomes.

Whatever eye disease or issue you are dealing with, you can book an appointment at Al Batal Specialized Complex for a comprehensive eye examination and to start treating your condition, no matter how complex it may be.

Frequently Asked Questions About Whether Bupa Insurance Covers Vision Correction

How can I find out which hospitals are covered by my insurance?

You can find the list of hospitals and providers covered by your insurance by visiting the Council of Health Insurance website and clicking on the icon to download the list of healthcare providers as an Excel file, via the link shown in the blue notification on the site.

Does Bupa insurance cover all types of vision correction procedures?

No. The standard health insurance policy does not cover these surgeries except in certain specific medical cases.

Can I have an individual health insurance policy?

Yes, individual health insurance policies are available in Saudi Arabia.

When is my health insurance activated?

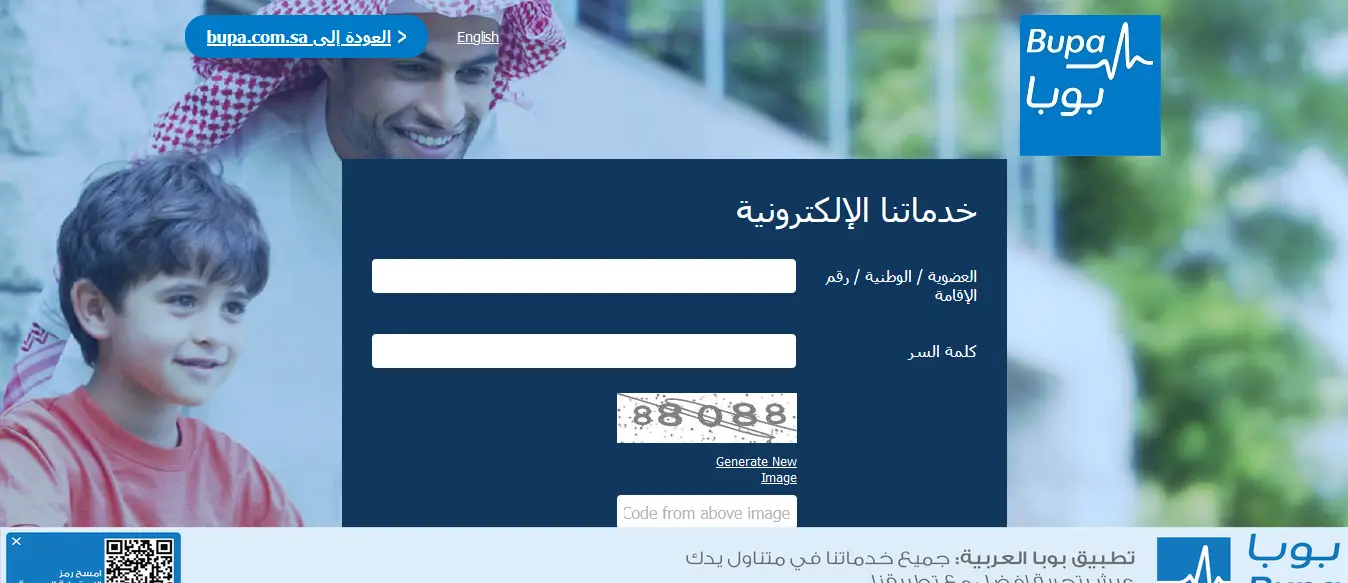

Your account is activated by selecting “Create Account,” entering your health insurance card number, and following the activation steps. A text message containing a verification code will be sent to you to complete the activation process. The app will automatically detect your membership number and then ask you to create your own password.

What does “coverage limit” mean in health insurance?

The coverage limit is the maximum financial liability of the insurer (the insurance company) as specified in the policy schedule, before applying any deductibles or cost‑sharing (such as co‑payment or depreciation percentages).